Duy Vu

September 5, 2025

•

20 mins read

Finance teams live in spreadsheets. Every month, quarter, and year-end close cycle means long nights buried in transaction logs, reconciliations, compliance reports, and endless formatting tasks. While most industries have slowly automated repetitive work, finance operations still rely heavily on manual processes, even though the stakes are higher — one mistake can mean compliance violations, costly audits, or regulatory penalties. That’s why AI for finance teams isn’t just about convenience; it’s about survival in a world where speed, accuracy, and compliance all matter at once. In this blog, we’ll explore how finance teams can use AI inside Retool to analyze transactions, detect anomalies, and automatically generate summary reports. Think of it as an automated reporting assistant that lives right inside your finance dashboard — always working, never tired, and always learning.

Let’s be real: financial reporting is one of the most painful processes in business operations. Finance teams deal with large volumes of raw data from ERP systems, accounting software, payment platforms, and bank feeds. Each of these sources has its own format, quirks, and reconciliation challenges. Pulling this data together into a single view is already hard enough. Turning it into accurate, audit-ready reports is a whole different game.

On top of that, manual reporting is slow. A typical mid-sized company’s finance team spends dozens of hours every week reconciling accounts, checking for anomalies, and preparing reports for leadership. Close cycles drag on, causing delays in decision-making. By the time a report reaches the CFO, the numbers may already be outdated. Add the constant pressure of compliance requirements, and finance teams are stuck in a loop of reactive reporting rather than proactive analysis.

This is where AI comes in. Unlike humans, AI thrives in large messy datasets, scanning thousands of transactions in seconds and flagging anomalies without bias or fatigue. Combined with Retool, which makes it easy to connect data sources and build custom dashboards, AI transforms finance reporting from a manual grind into an automated workflow.

Finance is one of the highest-value areas for AI adoption. Decision makers in finance aren’t just chasing efficiency — they’re also dealing with compliance, risk management, and shareholder expectations. AI helps finance teams operate faster, more accurately, and with less reliance on manual controls.

One of the biggest challenges in finance is anomaly detection. Spotting duplicate payments, fraudulent activity, or compliance red flags requires manual reviews today. AI can analyze transactions in real time, highlighting suspicious patterns long before humans would notice. Another critical area is reporting. Drafting monthly or quarterly reports eats up days of work for finance teams. AI can generate summaries, variance analyses, and compliance-ready drafts in seconds, freeing humans to focus on higher-value interpretation rather than data wrangling.

Most importantly, AI doesn’t replace finance professionals — it supports them. Instead of spending hours formatting spreadsheets, finance managers can focus on strategic decisions, scenario planning, and advising leadership. AI becomes a reporting assistant rather than a replacement accountant.

If AI is the brain, Retool is the body that makes it useful. Retool provides the interface where finance teams can actually use AI insights without needing to switch tools or hire engineers to build complex dashboards. Retool connects seamlessly to accounting tools like QuickBooks, Xero, Netsuite, and Stripe, as well as internal databases. This means you can pull in all your finance data into one place, then use AI models (via APIs like OpenAI or AWS Bedrock) to process and analyze it.

Unlike traditional BI tools that focus mostly on visualizations, Retool gives you interactive dashboards. Finance teams can filter transactions, run anomaly checks, and trigger AI-generated reports directly in the interface. This is critical because finance workflows are never just about looking at data — they involve taking action, approving reports, or exporting documents for compliance. Retool’s flexibility makes it possible to customize dashboards for each team, whether you’re focused on monthly close, compliance checks, or real-time anomaly detection.

So how does this actually work in practice? Let’s walk through how a finance team can build an automated reporting assistant in Retool.

Start by connecting Retool to your finance data sources. This could be your accounting system (QuickBooks, Xero, or Netsuite), payment processors like Stripe, or even CSV uploads from banks. Retool makes this painless with pre-built connectors and APIs.

Once data is in Retool, AI models kick in. The assistant can categorize transactions, summarize spending, and flag anomalies like duplicate invoices or outlier expenses. For example, if a vendor payment is double the usual amount, AI can immediately flag it for review.

Here’s where the magic happens. Instead of manually drafting reports, AI generates summaries that highlight key numbers: total expenses, revenue changes, variance against budget, and anomalies detected. These reports are formatted in natural language so CFOs and managers can understand them instantly.

AI doesn’t operate in a vacuum. Finance managers review the AI draft, add context, and approve the final version. This keeps humans in control while leveraging AI’s speed and accuracy.

Once approved, the report can be exported as a PDF, sent via email, or pushed directly into Slack or Notion. This way, stakeholders always have the latest insights without waiting for the next finance meeting.

To make this real, let’s look at some scenarios where finance teams can benefit from AI-powered reporting in Retool.

The benefits of using AI for financial reporting are massive. Finance teams save hours every week by eliminating repetitive manual work. Anomaly detection reduces compliance risk and prevents costly errors. Leadership gets faster, real-time insights, which means better decision-making.

Let’s break it down:

If you’re new to AI in finance, the key is to start small. Don’t try to automate everything at once. Pick one workflow — for example, anomaly detection in transactions. Connect your accounting tool to Retool, add an AI API, and build a simple dashboard that flags anomalies. Once that’s working, expand to report generation, compliance checks, and board summaries.

The beauty of Retool is that you don’t need to wait on IT or data engineering. Finance teams can design their own dashboards, customize workflows, and integrate AI step by step. Over time, your reporting assistant becomes a central part of your finance operations.

Finance reporting has always been a grind, but it doesn’t have to be. By combining AI for finance teams with the flexibility of Retool, you can build an automated reporting assistant that saves time, reduces risk, and empowers smarter decision-making. Instead of drowning in spreadsheets, finance professionals can focus on strategy, compliance, and growth.

AI is not replacing finance teams — it’s the missing puzzle piece that makes reporting faster, smarter, and more reliable. And with Retool, implementing it is easier than ever.

👉 Want to see how this could work for your finance team? Get a Quote and let’s build your AI-powered finance dashboard today.

Looking to supercharge your operations? We’re masters in Retool and experts at building internal tools, dashboards, admin panels, and portals that scale with your business. Let’s turn your ideas into powerful tools that drive real impact.

Curious how we’ve done it for others? Explore our Use Cases to see real-world examples, or check out Our Work to discover how we’ve helped teams like yours streamline operations and unlock growth.

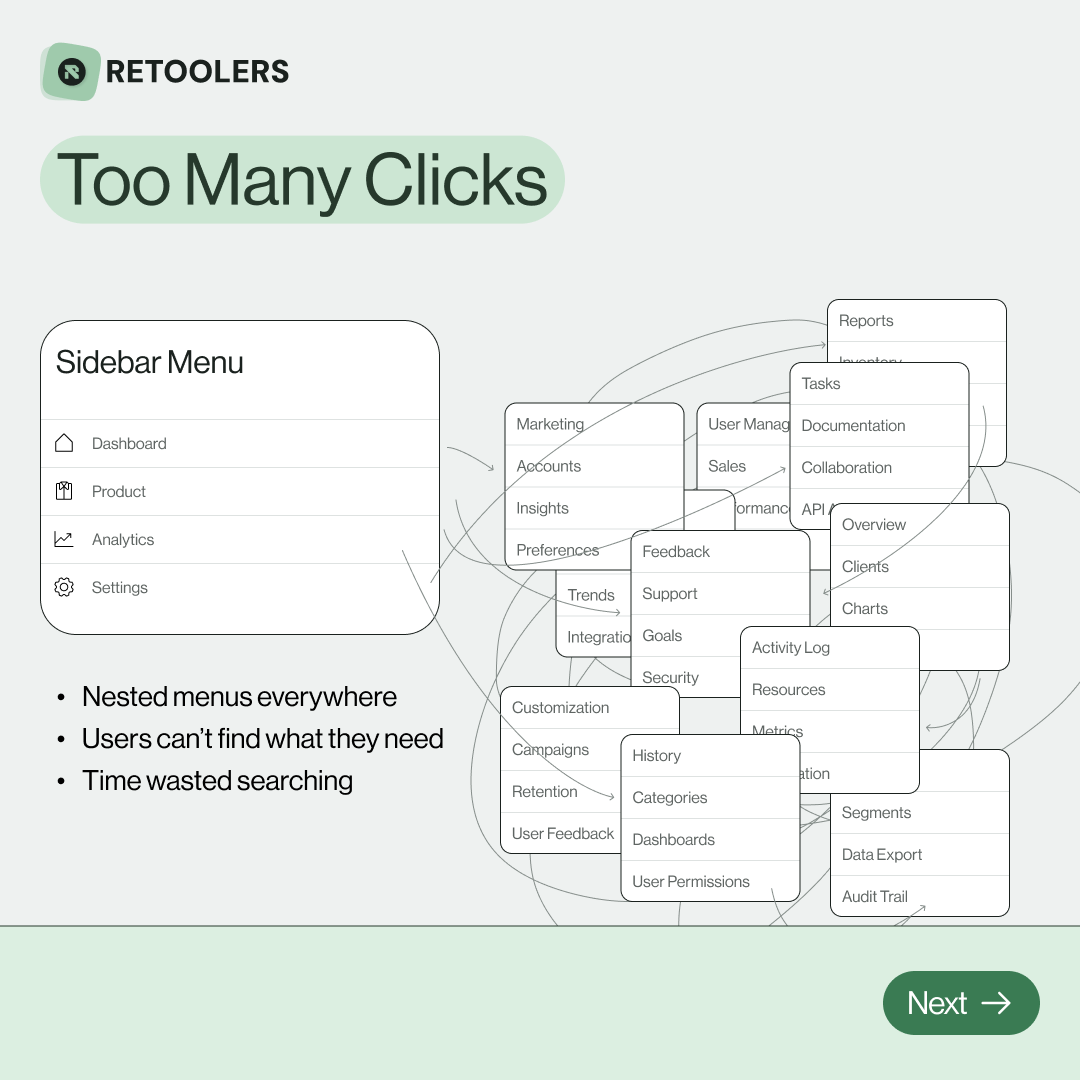

🔎 Internal tools often fail because of one simple thing: Navigation.

Too many clicks, buried menus, lost users.

We broke it down in this 4-slide carousel:

1️⃣ The problem (too many clicks)

2️⃣ The fix (clear navigation structure)

3️⃣ The Retool advantage (drag-and-drop layouts)

4️⃣ The impact (happier teams)

💡 With Retool, you can design internal tools that are easy to use, fast to build, and simple to maintain.

👉 Swipe through the carousel and see how better UX = better productivity.

📞 Ready to streamline your tools? Book a call with us at Retoolers.

🚀From idea → app in minutesBuilding internal tools used to take weeks.

Now, with AI App Generation in Retool, you can describe what you want in plain English and let AI do the heavy lifting.

At Retoolers, we help teams move faster by combining AI + Retool to create tools that actually fit their workflows.

👉 Check out our blog for the full breakdown: https://lnkd.in/gMAiqy9F

As part of our process, you’ll receive a FREE business analysis to assess your needs, followed by a FREE wireframe to visualize the solution. After that, we’ll provide you with the most accurate pricing and the best solution tailored to your business. Stay tuned—we’ll be in touch shortly!