Duy Vu

October 11, 2025

•

25 mins read

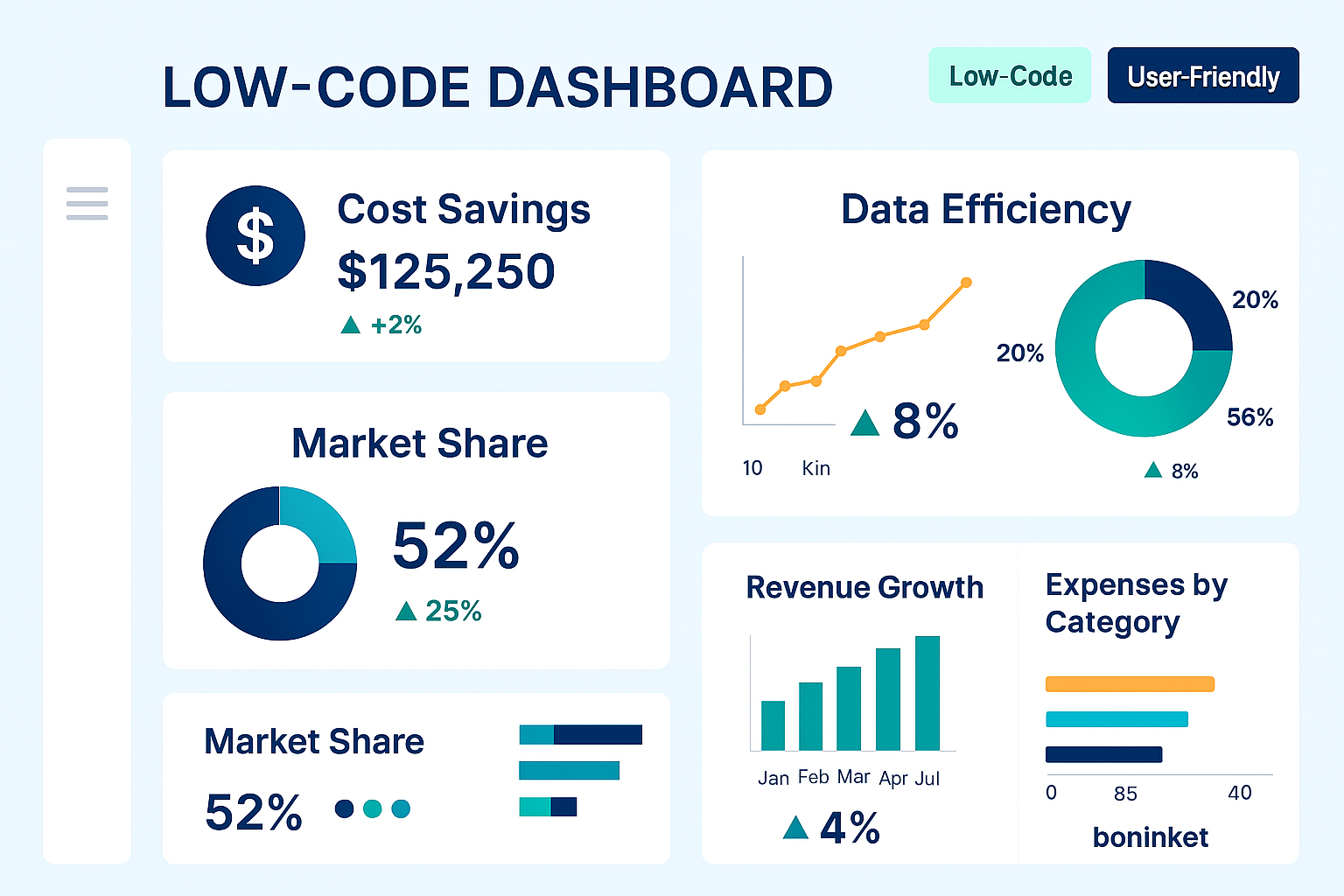

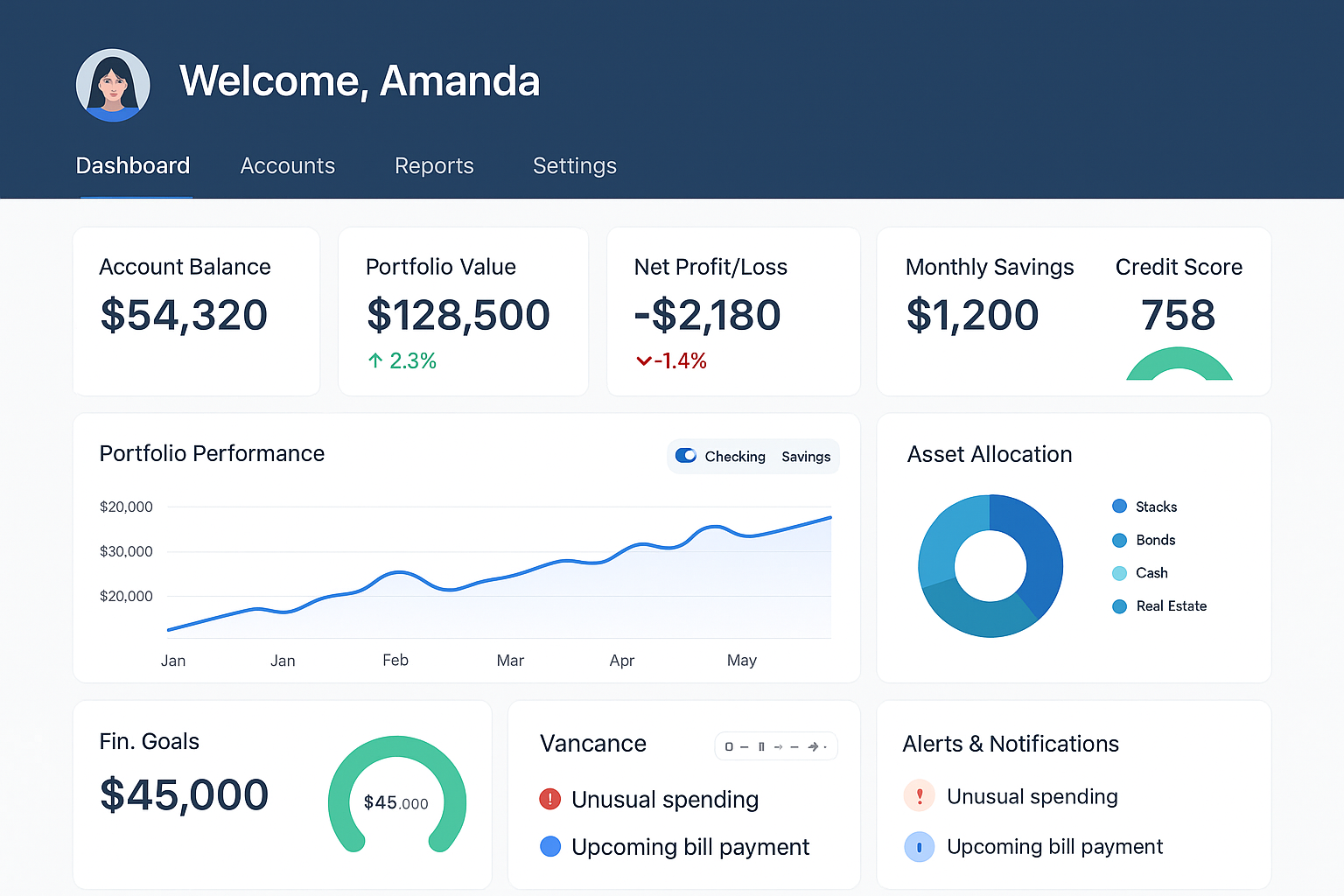

In today's fast-paced financial landscape, efficiency and data accuracy are paramount for companies aiming to stay competitive. As financial firms confront rising operational costs and an ever-increasing volume of data, innovative solutions are critical to adapting to market demands. Transform your financial services with low-code dashboards, cutting software costs by 40% and boosting data efficiency for a competitive edge in a $3B portfolio management. Low-code technology emerges as a powerful answer to these challenges, particularly through low-code dashboards for financial services. Retool, a leader in low-code solutions, is transforming the way financial services operate by enabling companies to leverage customized dashboards that streamline processes and enhance decision-making capabilities. This blog explores the myriad benefits of low-code dashboards, highlights their pivotal role in financial reporting, and discusses how these tools can help companies optimize their operations in the financial sector.

Low-code dashboards are user-friendly platforms that allow organizations to create customized applications with minimal coding skills. This approach democratizes app development, enabling professionals from diverse backgrounds—such as business analysts, finance experts, and project managers—to contribute to building applications without needing extensive programming expertise. These dashboards serve as essential financial reporting tools by providing an intuitive interface that integrates various data sources, enhances visualization, and streamlines operational management.

With an increasing focus on agility and innovation, low-code platforms empower financial institutions to react quickly to changes in regulation, market conditions, and customer demands. For example, firms can quickly develop bespoke dashboards that visualize key performance indicators (KPIs), automate reporting, and facilitate data analysis. This flexibility is particularly vital in an era marked by rapid technological advancement and shifting market dynamics.

The financial services industry faces several unique challenges, including:

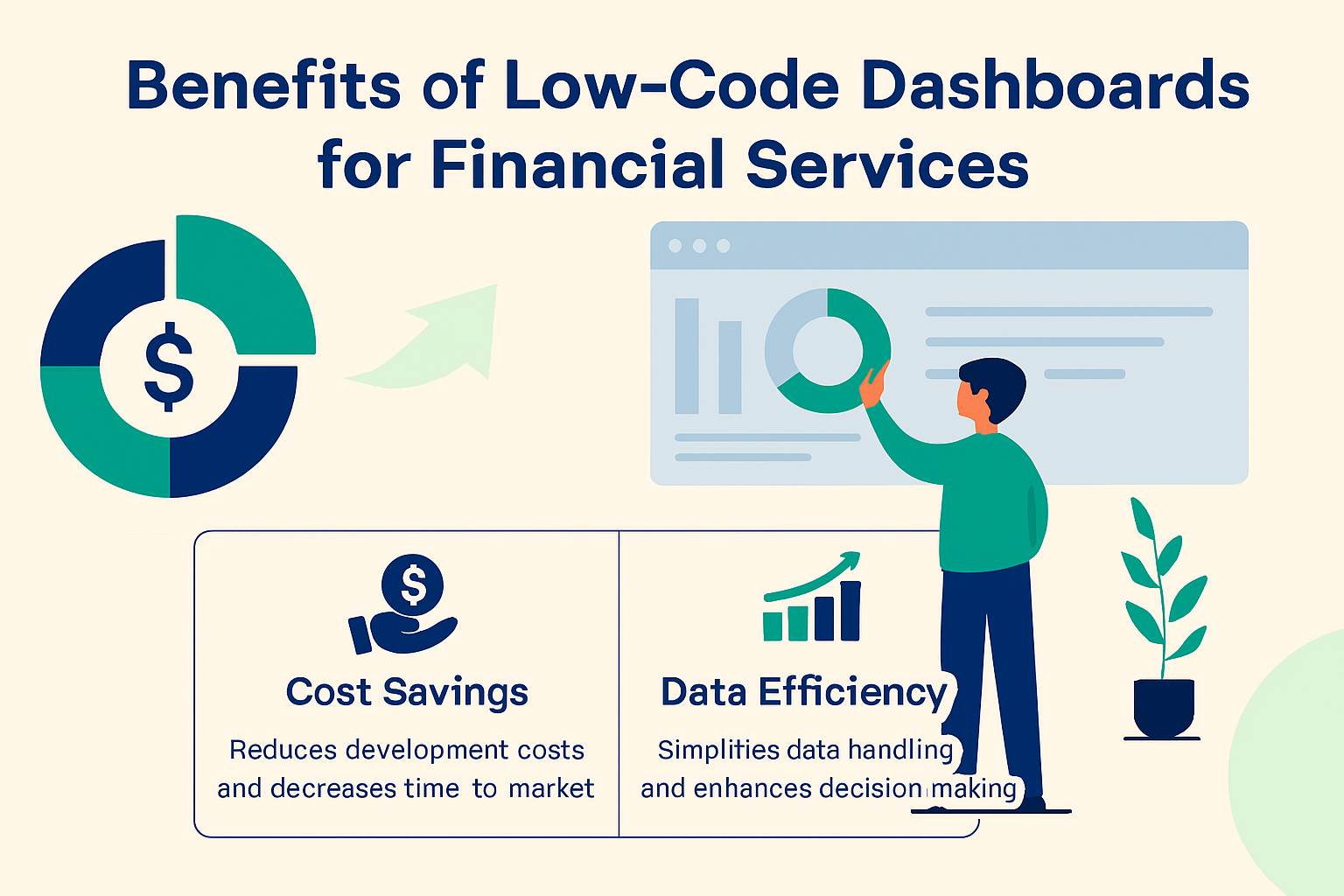

One of the most significant advantages of low-code dashboards is their ability to drastically reduce software development costs. By minimizing the need for extensive coding and costly software development, financial service firms can cut down on labor expenses and allocate resources more effectively.

For instance, a typical software development project can take weeks or months, requiring collaboration among multiple teams, including developers, designers, and business stakeholders. With low-code platforms, companies can significantly shorten development cycles. According to a report by Forrester, low-code development can reduce project delivery times by up to 70% compared to traditional development methods.

Additionally, reduced reliance on external consultants for custom software solutions results in savings on labor costs and accelerates the deployment of financial reporting tools, allowing firms to keep pace with changing market demands.

Low-code dashboards streamline various aspects of data management, including collection, analysis, and reporting. With the automation of these processes, organizations minimize the time spent on labor-intensive manual data entry, reducing the risk of human error. This enhancement in efficiency leads to faster, more informed decision-making, allowing firms to respond promptly to changing conditions and market opportunities.

Business intelligence dashboards offer a comprehensive view of key metrics and analytics, enabling financial services companies to identify trends and insights at a glance. For example, a financial services company can automate its monthly reporting processes through low-code solutions, consolidating data from multiple sources in real-time. This ensures accurate financial reporting dashboards that provide stakeholders with immediate access to vital data. An automated approach not only reduces the workload for finance teams but also increases confidence in the integrity of the data.

Every financial institution possesses distinct characteristics, and low-code dashboards provide the flexibility necessary for firms to customize applications that align with their specific operational demands. This ability to tailor solutions ensures that organizations maximize their technology investments.

Financial institutions may have diverse requirements based on their product offerings, target markets, or regulatory compliance needs. For instance, a wealth management firm may require dashboards focused on investment performance analysis, while a retail bank may prioritize customer transaction trends. Low-code platforms allow firms to develop bespoke applications that address these unique needs, ultimately translating directly into improved productivity and effectiveness across their operations.

In a rapidly changing market, the ability to swiftly deploy new applications is crucial. Low-code platforms support rapid application development, enabling financial firms to bring new solutions to market more quickly than traditional development methodologies would permit. This advantage can be the differentiating factor in a competitive landscape, helping businesses stay ahead of evolving trends and customer demands.

For example, during a financial crisis or a significant market shift, firms that can quickly implement responsive applications and dashboards can adjust their strategies and communicate effectively with stakeholders, positioning them favorably against competitors.

Another noteworthy benefit offered by low-code dashboards is their ability to function as a centralized platform where different departments can effortlessly share insights and data. By providing a space for transparency and open communication, these tools promote better collaboration among teams, leading to more cohesive strategies and ultimately driving superior business outcomes.

In financial institutions, many decisions depend on cross-department collaboration—between finance, risk management, compliance, and operations. Low-code dashboards facilitate this collaboration by allowing multiple teams to access and contribute to the same data sets. This shared understanding improves the decision-making process, reduces silos, and fosters a collaborative culture within organizations.

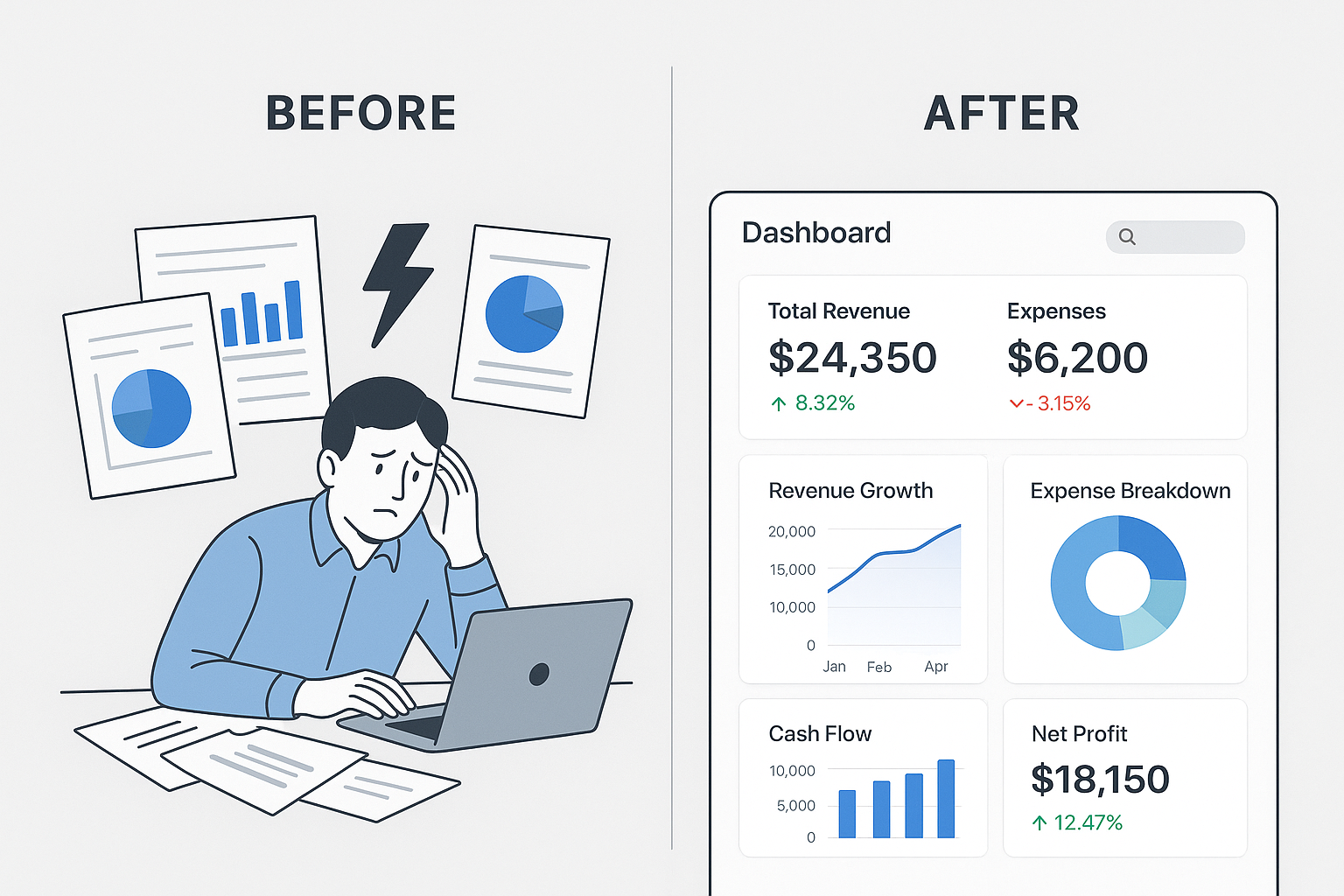

To illustrate the powerful impact of low-code dashboards, let's consider a case study featuring a leading financial services company managing a substantial $3 billion portfolio.

The financial institution was facing a myriad of challenges:

The application of low-code dashboards yielded transformative results for the organization:

In the fiercely competitive financial services industry, delivering exceptional customer experience is critical. Low-code dashboards not only empower internal teams but can also be leveraged to enhance the customer journey by providing real-time insights and personalized service.

Financial institutions can utilize low-code dashboards to create personalized experiences for clients. By aggregating data from various sources, firms can develop a comprehensive view of customer behavior, preferences, and needs. This information can inform targeted marketing strategies, personalized service offerings, and proactive engagement opportunities.

For example, a bank can use low-code tools to create dashboards that allow relationship managers to view a complete picture of a client’s financial activity, enabling them to tailor advice and solutions. This level of personalization enhances customer satisfaction and loyalty.

Low-code dashboards can simplify the reporting process for clients, providing them with easy-to-understand visualizations of their financial performance and portfolios. Customizable reporting tools allow clients to access data that matters most to them, fostering transparency and trust.

Firms can automate the generation of personalized reports, reducing the workload on advisors and ensuring that clients have continuous access to the information they need to make informed decisions. For instance, a wealth management firm can generate dynamic dashboards for clients to track investment performance in real time.

The landscape of low-code technology is continually evolving, and several trends are expected to shape its future, particularly in financial services:

As artificial intelligence (AI) and machine learning technologies continue to advance, their integration with low-code platforms will become increasingly important. Financial institutions can leverage AI-driven insights to enhance decision-making, automate processes, and optimize operational efficiency. Low-code dashboards can provide the necessary user interface for data scientists and analysts to build AI-driven models and visualize their outputs.

The democratization of software development through low-code tools has given rise to “citizen developers”—non-technical users who create applications for their own and others' usage. This trend will continue to expand as more professionals leverage low-code platforms to address specific business needs without relying solely on IT departments.

Future iterations of low-code dashboards are likely to include enhanced collaboration features that facilitate communication and project management across teams. By integrating chat functions, project tracking, and shared dashboards, low-code platforms can streamline collaboration and improve productivity.

As financial services firms integrate low-code solutions, the focus on security and compliance will intensify. Future platforms will likely adopt more robust security measures and compliance frameworks, ensuring that data is protected and regulatory requirements are met.

As technology continues to evolve, financial service companies must remain adaptable to maintain a competitive edge. Low-code dashboards represent a scalable, cost-effective solution that not only enhances operational efficiencies but also propels business growth and development. The implementation of low-code tools can effectively address pressing industry challenges, from reducing costs to improving decision-making speed and enhancing collaboration.

For operations managers and chief technology officers, embracing such innovative technology is essential for achieving operational excellence and effectively navigating the complexities inherent in the financial landscape. By investing in solutions like Retool's low-code dashboards for financial services, financial firms can unlock their full potential and ensure resilience and ongoing success in an ever-evolving marketplace.

In conclusion, embracing low-code technology is not just about staying afloat; it's about thriving in a new era of financial services where agility, speed, and data-driven insights are essential for sustainable growth. Low-code dashboards will continue to play a pivotal role in defining the future landscape of finance—enabling firms to innovate, collaborate, and ultimately deliver superior value to their clients.

Stop wasting hours on scattered tools. Let Retoolers build your custom dashboard and streamline your operations today. Book a call with us!

Looking to supercharge your operations? We’re masters in Retool and experts at building internal tools, dashboards, admin panels, and portals that scale with your business. Let’s turn your ideas into powerful tools that drive real impact.

Curious how we’ve done it for others? Explore our Use Cases to see real-world examples, or check out Our Work to discover how we’ve helped teams like yours streamline operations and unlock growth.

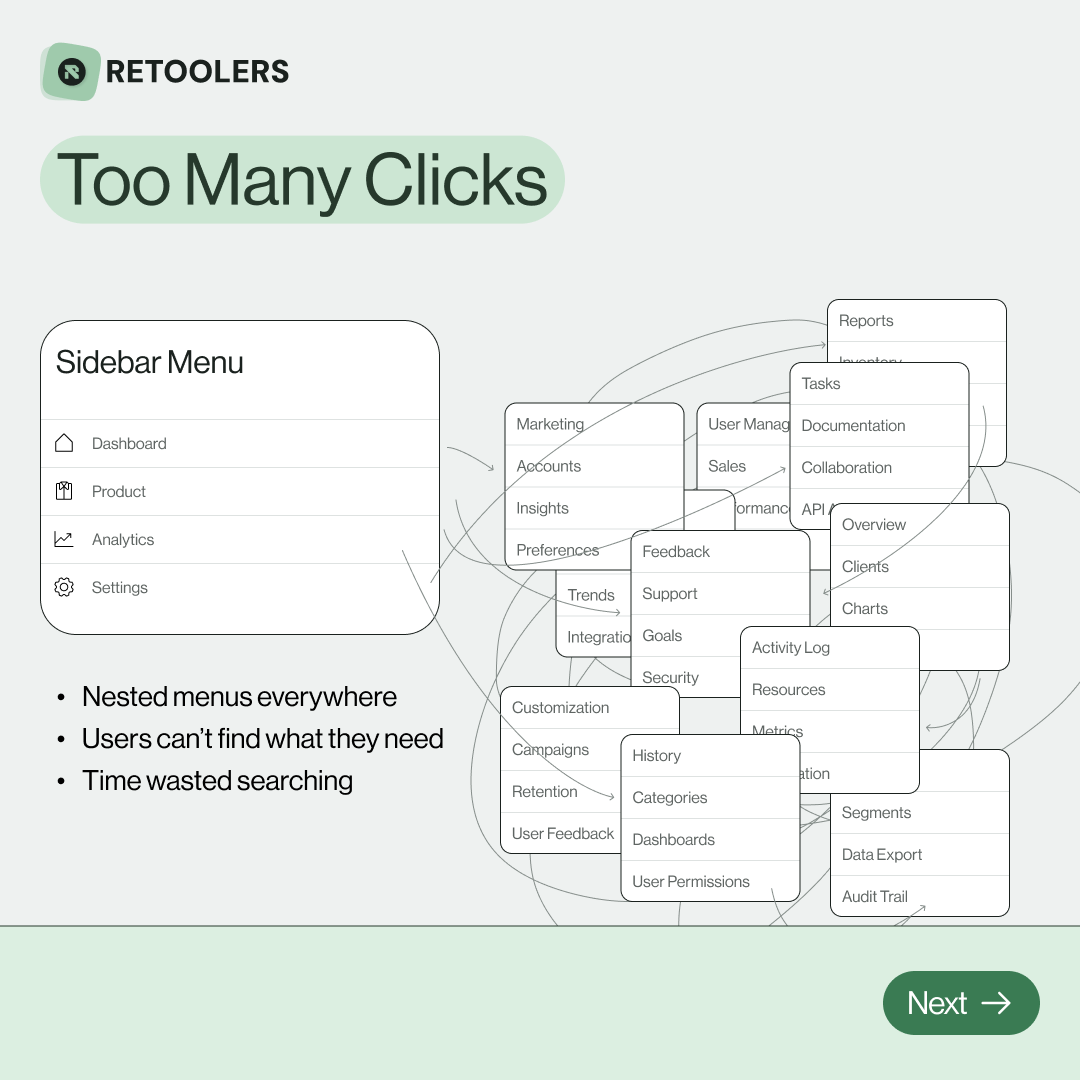

🔎 Internal tools often fail because of one simple thing: Navigation.

Too many clicks, buried menus, lost users.

We broke it down in this 4-slide carousel:

1️⃣ The problem (too many clicks)

2️⃣ The fix (clear navigation structure)

3️⃣ The Retool advantage (drag-and-drop layouts)

4️⃣ The impact (happier teams)

💡 With Retool, you can design internal tools that are easy to use, fast to build, and simple to maintain.

👉 Swipe through the carousel and see how better UX = better productivity.

📞 Ready to streamline your tools? Book a call with us at Retoolers.

🚀From idea → app in minutesBuilding internal tools used to take weeks.

Now, with AI App Generation in Retool, you can describe what you want in plain English and let AI do the heavy lifting.

At Retoolers, we help teams move faster by combining AI + Retool to create tools that actually fit their workflows.

👉 Check out our blog for the full breakdown: https://lnkd.in/gMAiqy9F

As part of our process, you’ll receive a FREE business analysis to assess your needs, followed by a FREE wireframe to visualize the solution. After that, we’ll provide you with the most accurate pricing and the best solution tailored to your business. Stay tuned—we’ll be in touch shortly!